F&G: 80

Price: $86-90k (or) £68-71k

Hashrate: 709 EH/s

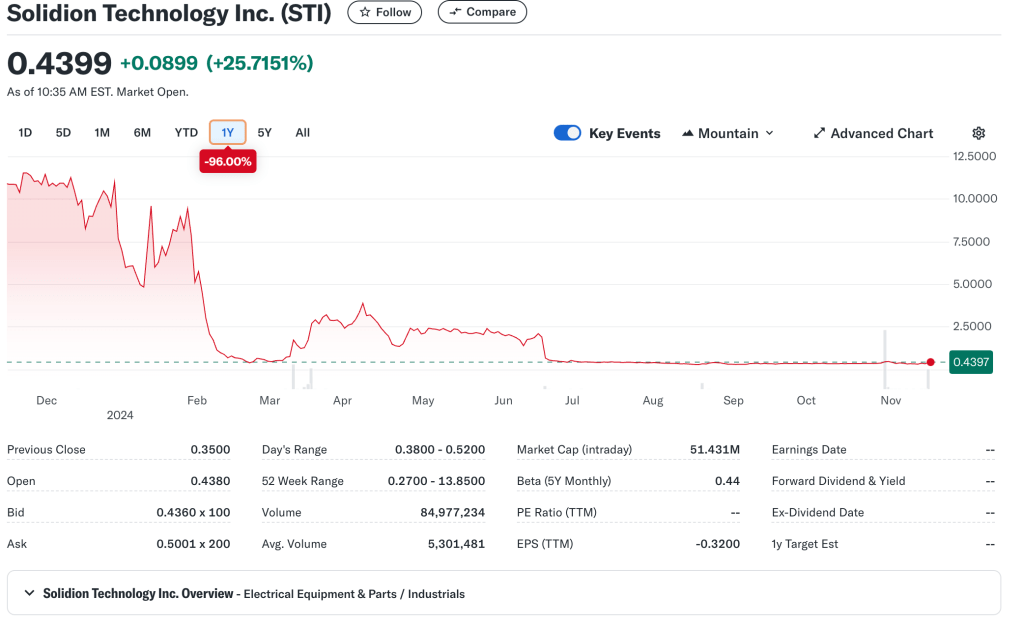

I saw on X today that Solidion Technology – a US based company that produces battery technology – just announced their plans to convert something like 60% of their cash flow into bitcoin with the intention of keeping it as a bitcoin treasury for the company. Below is their stock over the last year:

As you can see, it doesn’t look great. But after today’s announcement, I am going to be keeping an eye on their performance, so stick around to see what happens. In the meantime, let’s have a look at another company that also began converting its cash into bitcoin…

This chart is for Microstrategy. 10 points if you can guess when they started buying bitcoin.

Microstrategy is a little bit different, however, as they have become something akin to a ‘bitcoin bank’, and Michael Saylor has even made his intentions clear on this point. Microstrategy under Saylor’s leadership is indeed striving to become the world’s first bitcoin bank, and chances are it’s going to happen. That’s what I’m betting on, anyway.

Part of the reason for Microstrategy’s success is the so called ‘infinite money glitch’. This financial cheat code that Microstrategy has adopted is that they issue debt and then buy bitcoin with the proceeds. That’s really as simple as it gets. It’s a little more complicated in practice, of course, but that’s the fundamentals of it.

They issue debt and then they buy and hold bitcoin.

And a lot of it.

This approach has resulted in Microstrategy’s stock perform incredibly well and it probably even saved the company from its demise.

But what does all of this mean for you and me?

It means that Microstrategy acts as a sort of Bitcoin proxy. In simple terms, this means that you can get exposure to bitcoin without directly holding it. And for full disclosure: this is an approach that I have taken personally. I have invested into MSTR – notably through my pension. This means that I can allocate to Bitcoin and reap the rewards of the inherent volatility without having any risk of losing the underlying asset because Microstrategy does all of the holding. It also means that I can benefit from using my employer contributions to purchase more exposure to Bitcoin. And if you take that a little further still, it means that even my employer is now investing into bitcoin without realising it.

This is not financial advice, of course.

But now you start to see the financial storm taking place. Microstrategy took the risk and it paid off. Now, other companies are starting to pay attention and some, like Semler Scientific and Solidion Technology, have openly declared their intent to copy the MSTR playbook. And whilst we’re on this point, it’s worth reminding ourselves that Microsoft is still voting on this very prospect. Remember that they had put it to a vote earlier this month or late last month whether they would begin to hold bitcoin on the Microsoft balance sheet or not. It will still be some time before that vote is decided, around December I believe. Meanwhile, the price of bitcoin is exploding to the upside, and every day that Microsoft delays, the more gains they lose.

At least they didn’t sell 50,000 bitcoin like the Germans did a few months ago. A move that cost them around $1.8 billion, it should be added.

Again, nothing that we post here at Sovereign Digital is financial advice. If that is what you are looking for, go and seek a financial adviser. But if you want to know how Bitcoin works and how its changing the world and how you can get on board, this is the place to be.

Stay posted for further developments.

Because it’s going to be a wild ride.

Leave a comment