F&G: 90

Price: $90-93.9k (or) £71-74k

Hashrate: 757 EH/s

Reachable Nodes: 19,338

I’ve been harping on about supply and demand for a few days now. But this is because it really is one of the biggest factors that determines Bitcoin’s price.

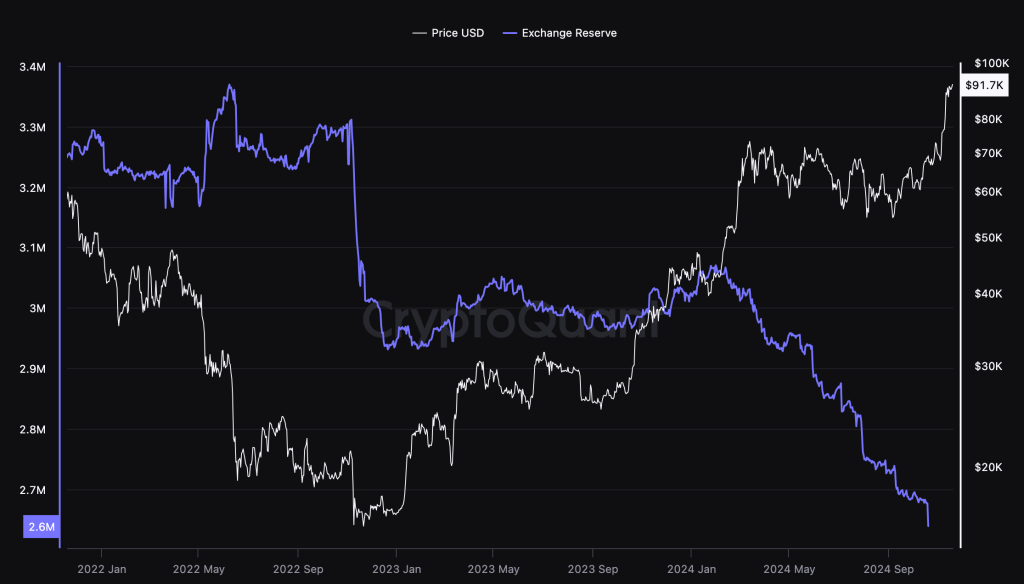

The white line of the chart above shows the price of bitcoin. The blue line traces the amount of bitcoin held on exchanges. As you can see, the trend is clear:

Bitcoin is leaving exchanges at an accelerating rate, and there will soon only be 2.6 million bitcoins left on exchanges.

If that sounds like a lot and you don’t feel at least a little bit of worry, let me try and dispel that.

Blackrock and MicroStrategy have been buying a copious amount of bitcoin recently. I think, if memory serves me correctly, Blackrock’s Bitcoin fund IBIT swallowed up 42 days worth of daily issuance of bitcoin in one day. That’s almost a month and a half’s worth. And in the last day or so, it has been revealed that MicroStrategy acquired another 51,780 bitcoin.

This is just a fraction of the scale of demand for this digital asset. And if you still think that 2.6 million bitcoin left on exchanges is a lot, then you are forgetting something.

The bitcoin remaining on exchanges does not necessarily mean that it is bitcoin for sale. Exchanges like Coinbase are custodians. They hold the bitcoin you purchase until you choose to either sell it or take it off from the exchange. Again, the trend is clear.

Bitcoin is leaving the exchanges, and at some point, as the price continues to rise and inflation continues to drain the purchasing power from everyday people’s bank accounts, more and more people, family offices and institutions are going to flee for the safety of this asset. Meanwhile, the bitcoin on exchanges will continue to drain away into private wallets. At some point I expect we will reach something akin to a critical point. We will come to a point in time where the realisation hits for most people and en masse they will race to acquire bitcoin, at which point there will barely be anything left.

Aside from bitcoin being drained from exchanges, the hash rate of the network is once again on the rise. The ATH is around 766 EH/s and we are now at 757. I expect this will continue and the price will follow. We are, in the last hour or so, within an inch of $94,000 bitcoin as well, which will be a new all-time high.

My money is on Bitcoin hitting $100k this week.

Stay tuned to see if we’re right.

Leave a comment