F&G: 83

Price: $91 – 94.7k (or) £71.9 – 74.6k

Hashrate: 773 EH/s

Reachable Nodes: 18,985

MicroStrategy Stock: Approaching $500

Something interesting is happening right now.

Let me tell you a story.

In 2021, Gamestop, a brick and mortar games store – much like Game in the UK – was facing financial difficulties due to the rise in digital game downloads. Nobody was buying physical games anymore, and this was exasperated in part due to the Covid lockdowns. As a result, many institutional investors – hedge funds in particular – began to short the stock. Put simply, Wall Street was betting that the stock would continue to tank, and they shorted it in order to make a quick and easy buck.

Or so they thought.

Now, if you’re wondering what a short is, the following definition from Investopedia should suffice for now:

‘A short, or a short position, is created when a trader sells a security first with the intention of repurchasing it or covering it later at a lower price. A trader may decide to short a security when they believe that the price of that security is likely to decrease in the near future.’

With that in mind, this meant that a lot of money was selling GME (Gamestop) stock that they did not have in the hopes that it would fall in price and they could buy it back dirt cheap. But that’s not how it played out.

In late 2020 and early 2021, users on WSB noticed the heavy short interest in GameStop, meaning a large percentage of the company’s shares were borrowed and sold short by hedge funds. Word quickly spread via the Reddit forum called Wall Street Bets (WSB) and the internet did what the internet does best.

It rallied.

WSB members came together via the power of the internet and coordinated to buy and hold GameStop stock, driving up the price. From it was born the meme, ‘I just like the stock.’

As the price surged, short sellers (mainly Wall Street) faced significant losses, forcing them to buy back shares to cover their positions which further inflated the price in a feedback loop known as a short squeeze (the first sharp spike upwards on the chart above).

At its peak, GameStop’s stock price rose over 1,700%, from under $20 in early January 2021 to over $480 by the end of the month. It was a pivotal moment in financial history and it demonstrated very clearly just how powerful the internet can be. Many viewed it as a rebellion of sorts against Wall Street. If it was, it was clearly successful as short sellers lost around $12 billion in total.

This saga quickly caught the attention of the legacy media and even Congress. There was also the move on the part of trading platforms such as Robinhood to temporarily restrict purchases of GameStop and other “meme stocks,” citing regulatory and liquidity concerns. This move was criticised as protecting hedge funds and it sparked a broader debate about fairness in the financial markets. Some short sellers were so enraged that they even suggested making platforms like WSB illegal.

This was the Gamestop saga in a nutshell and the reason that I bring it up is because something similar may be about to happen. The only difference this time is that the roles could be reversed.

WSB vs Bitcoin Maxis

If you have been reading some of the articles published here at Sovereign Digital, you will have seen the mention of MicroStrategy.

MicroStrategy borrows money at 0% interest and buys Bitcoin. That’s as simple as it gets.

And this is the result:

But what does MSTR have to do with Wall Street Bets?

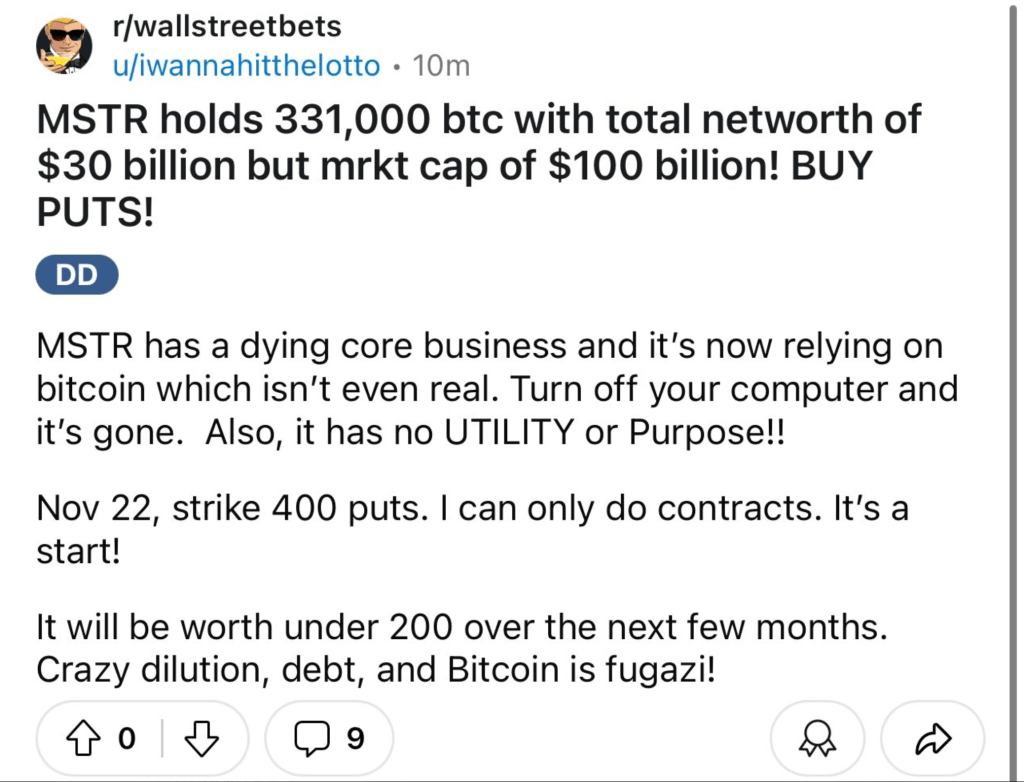

It may be the case that a large portion of the WSB community begins to short MSTR stock, which is basically a short against bitcoin as MicroStrategy is something akin to a bitcoin proxy stock (MicroStrategy allows investors who would otherwise be unable to invest in Bitcoin due to regulations the ability to gain exposure to Bitcoin through the purchase of MicroStrategy stock.)

I don’t know if they will short it or not, but there are a lot of people calling MSTR a bubble. The question is just how many of the WSB community will get behind this move. Michael Saylor is on record saying that he wants investors and hedge funds to short his stock. That’s how confident he is that bitcoin is going up.

Again, traditional investors are absolutely flummoxed that MSTR has performed the way it has. Their response is that it is overbought, overpriced and worthy of a correction, and so they may attempt to short MSTR in hopes of making a quick buck.

But what if MSTR doesn’t dip? What if it continues to rise? What if a large portion of the WSB community get behind the short on MSTR?

In that case, we could see another retelling of the GME saga. Only this time, it might be WSB and Wall Street joining forces against Bitcoin Maxis.

It is an interesting thing to occur and one that is definitely worth watching. I will therefore be recording the price of the MSTR at the top of these posts.

Leave a comment