F&G: 80

Price: $94 – 98k (or) £74 – 77k

Hashrate: 745 EH/s

Nodes: 17,458

MSTR Price: $375 – $398

Michael Saylor’s presentation to Microsoft was delivered. You can view it here:

It’s an important moment. Microsoft has long been a tech giant in today’s world. It is the operating system and interface of much of the worlds digital infrastructure and has been around since I was a kid. But things are changing. And Microsoft needs to change as well. If it doesn’t, it is going to get left behind.

The same will be said for many companies and organisations out there. Any individual or organisation/company that relies on money to get things done is now automatically at a disadvantage if they do not hold bitcoin on their balance sheet. This is because inflation is starting to ramp up – and it will continue to do so. We are in the midst of a debt doom spiral and there is no other alternative.

It was announced today that MSTR purchased another 15,400 BTC. This puts MSTR’s bitcoin balance at a little over 400,000 coins – an impressive 2% of the total supply.

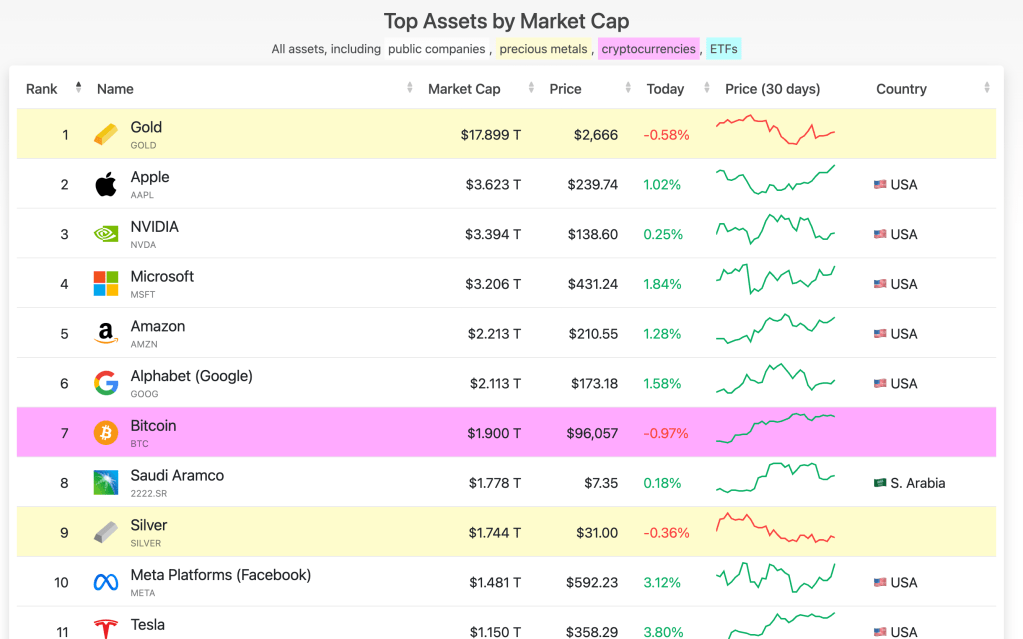

The US has just moved around 20,000 BTC that they had seized from Silk Road. The US holds around 210,000 BTC (all of it seized) and they have been moving a of their confiscated holdings as of late. Every time they move the bitcoin, the price tends to dip as the the market gets scared off. It was also notable that after Trump had announced his intention to launch a Strategic Bitcoin Reserve in July of this year, there were rumours that the current administration was going to sell it off. This never happen, but I remember it being a distinct possibility at one point. But I think the time for that has now passed. It is clear that the future lies with Bitcoin – it is clearly the best performing asset and is currently the 7th largest asset in the world:

I am of the opinion that Bitcoin will replace gold at some point in the future. It could be 5, 10 or 50 years away, but I am confident that it will happen.

Only time will tell.

Onwards to $100k.

Leave a comment